Daniel J. Nesbitt ’22

Managing Editor

The Tripod conducted a brief review of Trinity’s financials using the publicly available IRS Form 990, an IRS form filed by all tax-exempt non-profit organizations, and Trinity’s Consolidated Financial Statements available on the college website.

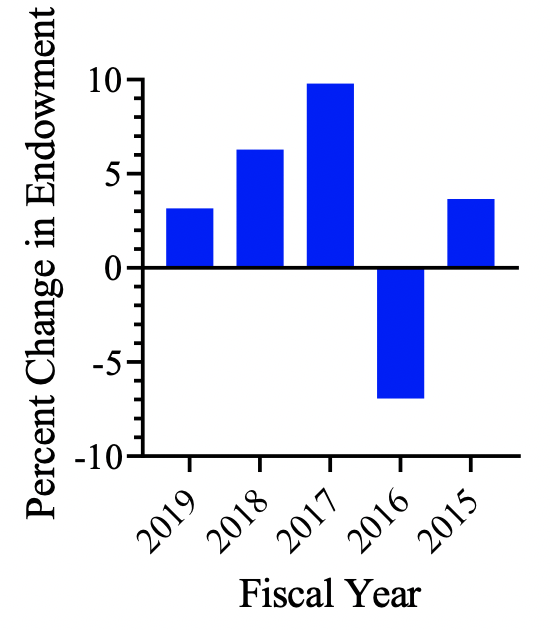

The 990 data indicate that the College’s endowment increased by approximately 3.16% for fiscal year (FY) 2019 (Note: FY 2019 spans from July 1, 2018 through June 30, 2019). The percent change in endowment for FY 2019-2015 is shown in the figure above. As shown in the figure, the 3.16% increase for FY 2019 is continuing a downward trend from FY 2017. It is worth noting that the percent change in endowment data was not adjusted for inflation. The percent change in endowment peaked at 9.80% for FY 2017 and the minimum was a -6.94% change for FY 2016.

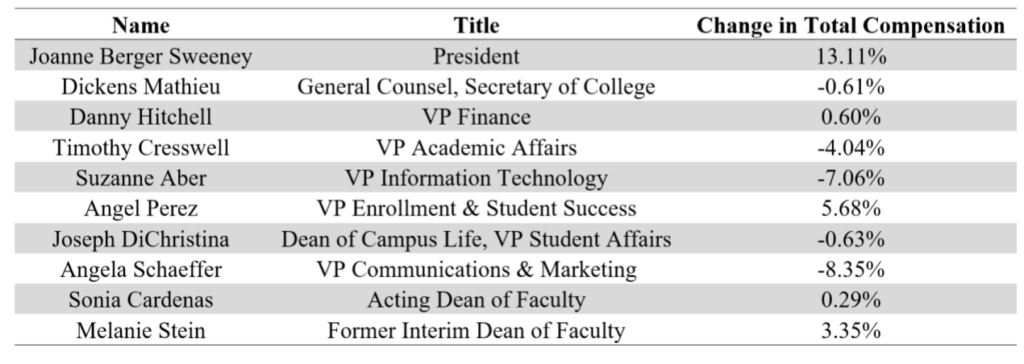

The 990 data also include the yearly total compensation for “officers, directors, trustees, key employees, and highest compensated employees” of the College, including base compensation, bonuses, other reportable compensation, retirement and other deferred compensation, and nontaxable benefits. The total compensation of the listed individuals for FY 2019 and FY 2018 were calculated and corrected for inflation using an inflation calculator made available by the Bureau of Labor Statistics. President Berger-Sweeney’s overall compensation increased 13.11% from $744,735.75 to $842,336 (2019 dollars).

Notably, Berger-Sweeney’s contract was renewed at the beginning of FY 2019, which could account for this increase. The compiled data for College officials’ total compensation, adjusted for inflation, listed in the Form 990 are shown in the table. VP of Advancement Michael Casey and Former VP of Advancement John Fracasso were excluded from the table due to odd timings in positional changes resulting in compensation changes exceeding +/- 60%. Additionally, Director of Human Resources (until Sep. 1, 2018) Beth Iacampo was not included as she was not listed on the 990 for FY 2018.

In addition, the College Consolidated Financial Statement for June 30, 2019 and 2018 showed significant changes in the allocation of Trinity’s investments. It is important to note that the numbers provided in this article are approximations – the full data is available online at Trinity’s website.

For 2019, Trinity held $35M in short-term investments compared to $430M in 2018. Conversely, the College held $60M in fixed income in 2019, but only $3M in 2018. The College also had significantly more investment in domestic equity in 2019 ($227M) than in 2018 ($7.5M).

In private equity, Trinity College invested an additional $16M, bringing the total amount of funds to $165M. The College similarly invested an additional $16M in real estate, bringing the total amount of funds to $22M. Trinity greatly increased their stake in domestic equity hedge funds during the most recent reportable year, investing $45M in 2019 compared to $9M the previous year while decreasing their stake in private equity hedge funds from around $374,000 to around $2,900.

+ There are no comments

Add yours